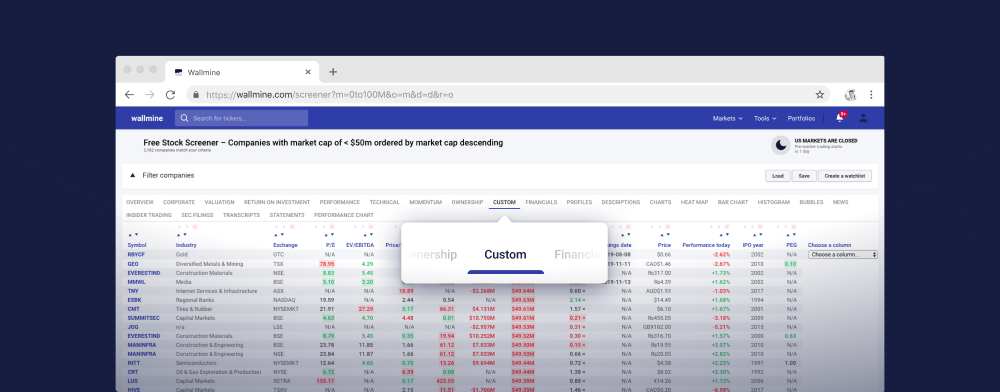

Free Stock Screener

Load Save Create a watchlist Help| Market cap | $22.90M |

|---|---|

| Enterprise value | N/A |

| Revenue | $24.400M |

|---|---|

| EBITDA | N/A |

| Income | -$4.49 |

| Revenue Q/Q | -34.62% |

| Revenue Y/Y | -12.15% |

| P/E | 0.00 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.67 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.94 |

| P/FCF | N/A |

| Price/Book | 3.66 |

| Book/Share | 0.17 |

| Cash/Share | 0.02 |

| FCF yield | -9.82% |

| Volume | 2.227M / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | N/A |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | -19.53% |

|---|---|

| Oper. margin | -18.80% |

| Gross margin | -1.43% |

| EBIT margin | -18.43% |

| EBITDA margin | -3.32% |

| Ret. on assets | -37.25% |

|---|---|

| Ret. on equity | -71.50% |

| ROIC | -38.69% |

| ROCE | -83.00% |

| Debt/Equity | 0.80 |

|---|---|

| Net debt/EBITDA | 2.03 |

| Current ratio | 1.73 |

| Quick ratio | 1.73 |

| Volatility | 9.85% |

|---|---|

| Beta | 0.34 |

| RSI | 43.72 |

|---|

| Insider ownership | 20.29% |

|---|---|

| Inst. ownership | 0.69% |

| Shares outst. | 7.205M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 1.01% |

| Short ratio | 0.47 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $39.74M |

|---|---|

| Enterprise value | N/A |

| Revenue | N/A |

|---|---|

| EBITDA | N/A |

| Income | -$9.70 |

| Revenue Q/Q | -36.14% |

| Revenue Y/Y | -0.57% |

| P/E | 0.00 |

|---|---|

| Forward P/E | 1.32 |

| EV/Sales | 0.91 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 1.33 |

| P/FCF | N/A |

| Price/Book | 0.64 |

| Book/Share | 0.23 |

| Cash/Share | N/A |

| FCF yield | -19.27% |

| Volume | 2.000k / 2.514k |

|---|---|

| Relative vol. | 0.80 × |

| EPS | N/A |

|---|---|

| EPS Q/Q | -266.67% |

| Est. EPS Q/Q | -110.53% |

| Profit margin | N/A |

|---|---|

| Oper. margin | -0.32% |

| Gross margin | N/A |

| EBIT margin | -78.77% |

| EBITDA margin | -465.79% |

| Ret. on assets | -0.13% |

|---|---|

| Ret. on equity | -80.89% |

| ROIC | -84.39% |

| ROCE | 4,628.38% |

| Debt/Equity | N/A |

|---|---|

| Net debt/EBITDA | 0.65 |

| Current ratio | 1.01 |

| Quick ratio | 0.82 |

| Volatility | 56.31% |

|---|---|

| Beta | 0.00 |

| RSI | 47.60 |

|---|

| Insider ownership | 19.21% |

|---|---|

| Inst. ownership | 22.73% |

| Shares outst. | 29.150M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 2.05% |

| Short ratio | 15.98 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $12.46B |

|---|---|

| Enterprise value | $13.28B |

| Revenue | $10.908B |

|---|---|

| EBITDA | $1.749B |

| Income | $1.032B |

| Revenue Q/Q | 1.63% |

| Revenue Y/Y | 0.89% |

| P/E | 11.41 |

|---|---|

| Forward P/E | 10.37 |

| EV/Sales | 1.22 |

| EV/EBITDA | 7.59 |

| EV/EBIT | 8.09 |

| PEG | 15.58 |

| Price/Sales | 1.14 |

| P/FCF | 13.38 |

| Price/Book | 3.16 |

| Book/Share | 9.79 |

| Cash/Share | 5.92 |

| FCF yield | 7.47% |

| Volume | 1.840M / 5.027M |

|---|---|

| Relative vol. | 0.37 × |

| EPS | 2.71 |

|---|---|

| EPS Q/Q | 0.00% |

| Est. EPS Q/Q | 21.95% |

| Profit margin | 10.09% |

|---|---|

| Oper. margin | 13.62% |

| Gross margin | 16.66% |

| EBIT margin | 15.06% |

| EBITDA margin | 16.04% |

| Ret. on assets | 5.85% |

|---|---|

| Ret. on equity | 27.01% |

| ROIC | 8.52% |

| ROCE | 18.82% |

| Debt/Equity | 3.86 |

|---|---|

| Net debt/EBITDA | 6.16 |

| Current ratio | 1.06 |

| Quick ratio | 1.06 |

| Volatility | 2.38% |

|---|---|

| Beta | 0.86 |

| RSI | 45.41 |

|---|

| Insider ownership | N/A |

|---|---|

| Inst. ownership | N/A |

| Shares outst. | 375.591M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 3.65% |

| Short ratio | 3.10 |

| Dividend | $0.97 |

|---|---|

| Dividend yield | 3.08% |

| Payout ratio | 35.79% |

| Payment date | 17 Sep 2024 |

| Ex-dividend date | 3 Sep 2024 |

| Earnings date | 18 Oct 2024 |

| Market cap | $16.66B |

|---|---|

| Enterprise value | $18.93B |

| Revenue | $15.123B |

|---|---|

| EBITDA | $2.226B |

| Income | $1.444B |

| Revenue Q/Q | 6.76% |

| Revenue Y/Y | 5.28% |

| P/E | 13.46 |

|---|---|

| Forward P/E | 11.09 |

| EV/Sales | 1.25 |

| EV/EBITDA | 8.51 |

| EV/EBIT | 8.58 |

| PEG | 5.64 |

| Price/Sales | 1.10 |

| P/FCF | 12.38 |

| Price/Book | 4.61 |

| Book/Share | 21.33 |

| Cash/Share | 26.14 |

| FCF yield | 8.07% |

| Volume | 1.039M / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | 7.30 |

|---|---|

| EPS Q/Q | 7.27% |

| Est. EPS Q/Q | 1.03% |

| Profit margin | 9.47% |

|---|---|

| Oper. margin | 14.53% |

| Gross margin | 18.44% |

| EBIT margin | 14.59% |

| EBITDA margin | 14.72% |

| Ret. on assets | 5.37% |

|---|---|

| Ret. on equity | 41.12% |

| ROIC | 7.92% |

| ROCE | 17.84% |

| Debt/Equity | 6.59 |

|---|---|

| Net debt/EBITDA | 6.28 |

| Current ratio | 0.93 |

| Quick ratio | 0.81 |

| Volatility | 1.91% |

|---|---|

| Beta | 0.80 |

| RSI | 58.12 |

|---|

| Insider ownership | 1.36% |

|---|---|

| Inst. ownership | 94.93% |

| Shares outst. | 195.649M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 5.75% |

| Short ratio | 6.38 |

| Dividend | $2.80 |

|---|---|

| Dividend yield | 2.79% |

| Payout ratio | 38.36% |

| Payment date | 11 Oct 2024 |

| Ex-dividend date | 20 Sep 2024 |

| Earnings date | 15 Oct 2024 |

CTV

| Market cap | $298.04M |

|---|---|

| Enterprise value | N/A |

| Revenue | $149.540M |

|---|---|

| EBITDA | N/A |

| Income | -$21.17 |

| Revenue Q/Q | 9.86% |

| Revenue Y/Y | 12.27% |

| P/E | N/A |

|---|---|

| Forward P/E | -8.84 |

| EV/Sales | 1.64 |

| EV/EBITDA | 982.82 |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 1.99 |

| P/FCF | 37.36 |

| Price/Book | 1.52 |

| Book/Share | 1.10 |

| Cash/Share | 0.28 |

| FCF yield | 2.68% |

| Volume | 153.385k / 417.011k |

|---|---|

| Relative vol. | 0.37 × |

| EPS | N/A |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | -96.61% |

| Profit margin | -22.81% |

|---|---|

| Oper. margin | -8.54% |

| Gross margin | 75.83% |

| EBIT margin | -8.54% |

| EBITDA margin | 0.17% |

| Ret. on assets | -8.71% |

|---|---|

| Ret. on equity | -10.97% |

| ROIC | -12.94% |

| ROCE | -6.07% |

| Debt/Equity | 0.28 |

|---|---|

| Net debt/EBITDA | -370.58 |

| Current ratio | 2.81 |

| Quick ratio | 2.81 |

| Volatility | 6.61% |

|---|---|

| Beta | 0.80 |

| RSI | 40.62 |

|---|

| Insider ownership | 16.61% |

|---|---|

| Inst. ownership | 62.77% |

| Shares outst. | 146.407M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 3.65% |

| Short ratio | 12.02 |

| Dividend | $0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 6 Nov 2024 |

| Market cap | $11.43B |

|---|---|

| Enterprise value | $15.92B |

| Revenue | £18.911B |

|---|---|

| EBITDA | £2.262B |

| Income | £642.900M |

| Revenue Q/Q | 10.16% |

| Revenue Y/Y | 6.94% |

| P/E | 13.27 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.69 |

| EV/EBITDA | 5.73 |

| EV/EBIT | 9.54 |

| PEG | 0.94 |

| Price/Sales | 0.73 |

| P/FCF | 18.17 |

| Price/Book | 2.66 |

| Book/Share | 18.21 |

| Cash/Share | 28.95 |

| FCF yield | 6.36% |

| Volume | 141.119k / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | 3.65 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 0.74% |

|---|---|

| Oper. margin | 9.53% |

| Gross margin | 16.97% |

| EBIT margin | 9.53% |

| EBITDA margin | 11.96% |

| Ret. on assets | 3.01% |

|---|---|

| Ret. on equity | 16.19% |

| ROIC | 1.27% |

| ROCE | 10.55% |

| Debt/Equity | 6.89 |

|---|---|

| Net debt/EBITDA | 2.81 |

| Current ratio | 0.91 |

| Quick ratio | 0.89 |

| Volatility | 1.39% |

|---|---|

| Beta | 0.76 |

| RSI | 64.15 |

|---|

| Insider ownership | 0.00% |

|---|---|

| Inst. ownership | 3.87% |

| Shares outst. | 215.711M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.00% |

| Short ratio | 2.07 |

| Dividend | $2.49 |

|---|---|

| Dividend yield | 5.22% |

| Payout ratio | 68.41% |

| Payment date | 1 Nov 2024 |

| Ex-dividend date | 11 Oct 2024 |

| Earnings date | N/A |

| Market cap | $1.48B |

|---|---|

| Enterprise value | $1.42B |

| Revenue | $1.358B |

|---|---|

| EBITDA | $74.575M |

| Income | $111.440M |

| Revenue Q/Q | 5.03% |

| Revenue Y/Y | 7.79% |

| P/E | 13.26 |

|---|---|

| Forward P/E | 18.66 |

| EV/Sales | 1.05 |

| EV/EBITDA | 19.04 |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 1.09 |

| P/FCF | 13.77 |

| Price/Book | 10.99 |

| Book/Share | 440.13 |

| Cash/Share | 341.96 |

| FCF yield | 7.26% |

| Volume | 13.097k / 57.730k |

|---|---|

| Relative vol. | 0.23 × |

| EPS | 364.67 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 8.01% |

|---|---|

| Oper. margin | 10.50% |

| Gross margin | 28.92% |

| EBIT margin | N/A |

| EBITDA margin | 5.49% |

| Ret. on assets | 43.09% |

|---|---|

| Ret. on equity | 78.95% |

| ROIC | 29.50% |

| ROCE | 0.00% |

| Debt/Equity | 0.77 |

|---|---|

| Net debt/EBITDA | -5.41 |

| Current ratio | 1.81 |

| Quick ratio | 1.64 |

| Volatility | 13.23% |

|---|---|

| Beta | 1.27 |

| RSI | 29.06 |

|---|

| Range | £4,857.49 – £4,940.00 |

|---|---|

| 52 weeks | £4,075.00 – £6,780.00 |

| SMA 50 | £5,629 -15.22% |

| SMA 200 | £5,985 -22.52% |

| Insider ownership | 2.99% |

|---|---|

| Inst. ownership | 83.25% |

| Shares outst. | 28.086M |

|---|---|

| Shares float | 27.564M 98.14% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | £179.70 |

|---|---|

| Dividend yield | 3.38% |

| Payout ratio | 49.28% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $217.65M |

|---|---|

| Enterprise value | $235.80M |

| Revenue | £453.920M |

|---|---|

| EBITDA | £30.316M |

| Income | -£3.54 |

| Revenue Q/Q | -1.49% |

| Revenue Y/Y | -1.86% |

| P/E | N/A |

|---|---|

| Forward P/E | 8.65 |

| EV/Sales | 0.42 |

| EV/EBITDA | 6.34 |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.39 |

| P/FCF | N/A |

| Price/Book | 6.00 |

| Book/Share | 32.99 |

| Cash/Share | 0.46 |

| FCF yield | -3.04% |

| Volume | 29.821k / 386.185k |

|---|---|

| Relative vol. | 0.08 × |

| EPS | -4.14 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | -0.78% |

|---|---|

| Oper. margin | 4.85% |

| Gross margin | 15.87% |

| EBIT margin | N/A |

| EBITDA margin | 6.68% |

| Ret. on assets | -1.37% |

|---|---|

| Ret. on equity | -12.59% |

| ROIC | 4.15% |

| ROCE | 0.00% |

| Debt/Equity | 7.37 |

|---|---|

| Net debt/EBITDA | 5.64 |

| Current ratio | 0.92 |

| Quick ratio | 0.93 |

| Volatility | 9.90% |

|---|---|

| Beta | 1.45 |

| RSI | 44.05 |

|---|

| Range | GBX198.00 – GBX203.00 |

|---|---|

| 52 weeks | GBX119.50 – GBX217.00 |

| SMA 50 | GBX205 -0.79% |

| SMA 200 | GBX192 +5.43% |

| Insider ownership | 36.75% |

|---|---|

| Inst. ownership | 57.68% |

| Shares outst. | 122.257M |

|---|---|

| Shares float | 74.560M 60.99% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | GBX1.60 |

|---|---|

| Dividend yield | 0.80% |

| Payout ratio | -38.68% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $10.94B |

|---|---|

| Enterprise value | $17.40B |

| Revenue | £14.851B |

|---|---|

| EBITDA | £1.515B |

| Income | £203.400M |

| Revenue Q/Q | 0.08% |

| Revenue Y/Y | -0.30% |

| P/E | 43.81 |

|---|---|

| Forward P/E | 8.00 |

| EV/Sales | 0.95 |

| EV/EBITDA | 9.36 |

| EV/EBIT | N/A |

| PEG | 0.94 |

| Price/Sales | 0.60 |

| P/FCF | 11.35 |

| Price/Book | 2.32 |

| Book/Share | 315.99 |

| Cash/Share | 182.82 |

| FCF yield | 10.82% |

| Volume | 215.206k / 2.352M |

|---|---|

| Relative vol. | 0.09 × |

| EPS | 16.77 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 0.74% |

|---|---|

| Oper. margin | 4.29% |

| Gross margin | 16.97% |

| EBIT margin | N/A |

| EBITDA margin | 10.20% |

| Ret. on assets | 0.78% |

|---|---|

| Ret. on equity | 5.22% |

| ROIC | 3.33% |

| ROCE | 0.00% |

| Debt/Equity | 5.95 |

|---|---|

| Net debt/EBITDA | 13.30 |

| Current ratio | 0.89 |

| Quick ratio | 0.89 |

| Volatility | 11.03% |

|---|---|

| Beta | 1.18 |

| RSI | 58.51 |

|---|

| Range | GBX743.80 – GBX748.60 |

|---|---|

| 52 weeks | GBX656.00 – GBX856.80 |

| SMA 50 | GBX720 +3.43% |

| SMA 200 | GBX753 -1.02% |

| Insider ownership | 0.65% |

|---|---|

| Inst. ownership | 55.71% |

| Shares outst. | 1.154B |

|---|---|

| Shares float | 1.114B 96.54% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | GBX39.40 |

|---|---|

| Dividend yield | 5.42% |

| Payout ratio | 234.95% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

ALP

| Market cap | $78.31M |

|---|---|

| Enterprise value | $60.82M |

| Revenue | €150.001M |

|---|---|

| EBITDA | €11.152M |

| Income | €7.366M |

| Revenue Q/Q | 16.49% |

| Revenue Y/Y | 9.81% |

| P/E | 13.52 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.40 |

| EV/EBITDA | 5.33 |

| EV/EBIT | 5.06 |

| PEG | N/A |

| Price/Sales | 0.46 |

| P/FCF | 10.24 |

| Price/Book | 3.71 |

| Book/Share | 5.79 |

| Cash/Share | 9.03 |

| FCF yield | 11.03% |

| Volume | 712.000 / 3.162k |

|---|---|

| Relative vol. | 0.23 × |

| EPS | 1.59 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 4.66% |

|---|---|

| Oper. margin | 7.16% |

| Gross margin | 44.97% |

| EBIT margin | 7.16% |

| EBITDA margin | 7.43% |

| Ret. on assets | 5.61% |

|---|---|

| Ret. on equity | 28.15% |

| ROIC | 5.65% |

| ROCE | 19.77% |

| Debt/Equity | 5.24 |

|---|---|

| Net debt/EBITDA | -9.35 |

| Current ratio | 1.19 |

| Quick ratio | 1.10 |

| Volatility | 2.66% |

|---|---|

| Beta | 0.92 |

| RSI | 67.73 |

|---|

| Insider ownership | 75.08% |

|---|---|

| Inst. ownership | 0.13% |

| Shares outst. | 3.952M |

|---|---|

| Shares float | 882.918k 22.34% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | €0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |